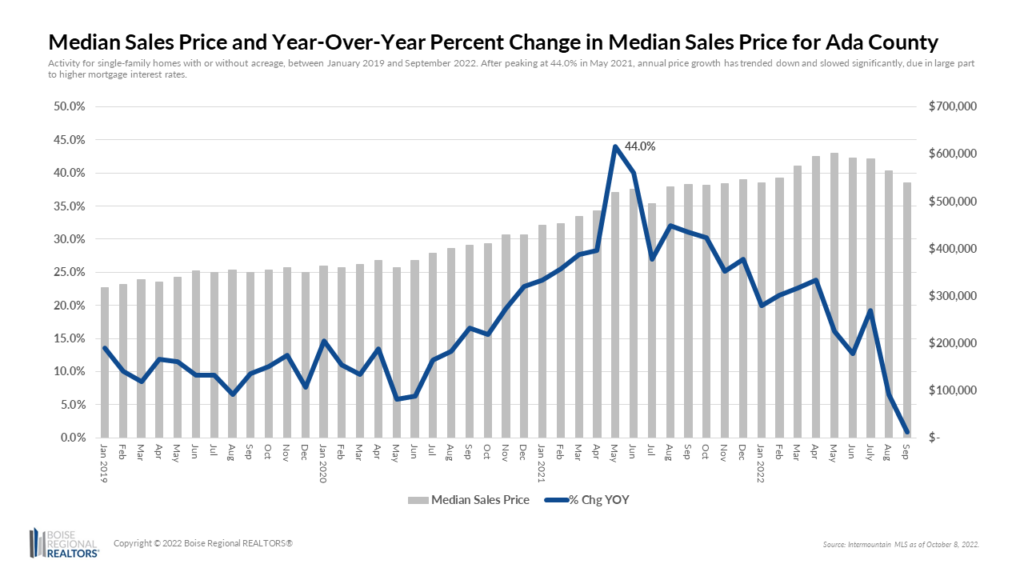

The median sales price for homes in Ada County was $540,000 in September, down 4.4% or $25,000 from the month prior, but 0.9% higher than September 2021. The median sales price dropped for the last four months, but we’ve yet to see a year-over-year decline in overall prices. After peaking at 44% in May 2021, annual price growth has trended down and slowed significantly, due in large part to higher mortgage interest rates

Home prices have declined year-over-year with regard to the existing/resale segment. The median sales price for existing homes was $500,000 in September 2022, which is a 4.8% dip from September 2021.

Previous market reports showed low mortgage interest rates drove demand for housing by increasing buyer’s purchasing power. The opposite is also true — higher mortgage interest rates decrease purchasing power and calm demand. According to Freddie Mac, retrieved from FRED, Federal Reserve Bank of St. Louis, the average 30 year fixed-rate mortgage was 6.7% on September 29, 2022, more than double the 3.0% average in September 2021 and throughout the majority of last year.

The Federal Reserve’s rate hikes and efforts to reduce inflation have had major impacts on the housing market, resulting in slower price growth and fewer sales. Buyers are making budget adjustments or pressing pause on their home search as they face higher monthly mortgage payments.

Single family home sales dipped 30.3% last month in Ada County and September marked the seventh month of year-over-year declines in sales. Compared to last year, sales are 15.1% lower year-to-date.

Less demand has caused inventory to accumulate given with 2,420 available listings on the Intermountain MLS at the end of the month, a 93.8% increase from September 2021. More inventory is good news for those who are able to buy in today’s market, as they aren’t facing the fierce competition for homes that we experienced a year ago. If rates drop in the future, buyers may opt to refinance and save on their monthly payments. Additionally, buyers have gained negotiation power.

Reports indicate negotiations have been had — the average original list price received for existing/resale homes in September was 92.5%, which means that on average, buyers paid less than asking through a lower accepted offer, price reductions or seller concessions. In September 2021, the average original list price received was 98%, meaning that on average, buyers paid slightly less than asking price for existing homes. Another metric that indicates competition that’s made a significant shift from a year ago is Days on Market. Existing homes that closed in September spent an average of 37 days on the market before going under contract, compared to 17 days in September 2021.

With the shifts in the housing market and economists talking about an overall recession, many are naturally asking, “What’s next?” REALTOR.com reports that housing experts anticipate that prices will decline in the next year, particularly in markets like ours, where we saw prices appreciate so quickly.

Understanding what’s happening with the housing market is helpful, but if you’re considering buying or selling a home, it’s more important to consider your unique circumstances and needs. Work with a real estate agent and a lender to learn about your options for achieving your real estate goals and come up with a plan that works for you.

To read more about the trends in the market, please see the Boise Regional Realtors September 2022 Market Report.